|

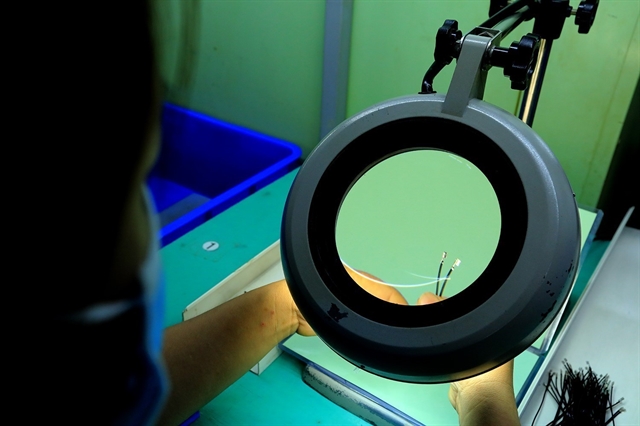

| Production at Japan-invested Sankoh Việt Nam in Hoà Bình Province. It’s the right time for Việt Nam to consider reforming the investment incentive system with the introduction of diverse and flexible investment policies to retain strategic investors and attract satellite businesses. — VNA/VNS Photo Tuấn Anh |

HÀ NÔI — The Ministry of Planning and Investment (MPI) has proposed investment incentive policies to be reformed for Việt Nam to remain appealing to foreign direct investment (FDI) in a new race sparked by the adoption of the global minimum tax (GMT).

It becomes vital for Việt Nam to reform investment incentives in the context of a rapidly changing and complicated world, the ministry said. The international business environment and cross-border investment face challenges. The global FDI flow is decreasing by 4 per cent while strategic competition among nations in attracting FDI is increasingly fierce.

Many countries have made strong moves in attracting and maintaining FDI influx, creating pressure but also motivation for Việt Nam to make a change.

Developed economies including the US, EU, Japan, India, Korea and Taiwan have issued strong preferential policies and subsidies on land, electricity, water and taxes to retain investments to promote a “strategic autonomous” economy or join with others to establish “prosperous economic network” with autonomy in the supply chain.

Developing countries which are emerging as options to replace China with low operating and production costs and available supply chains such as India and Southeast Asian countries are also striving to create a favourable business environment and enhance economic cooperation with the region to create competitive advantages in attracting FDI.

According to the ministry, GMT greatly affects existing tax incentives, requiring prompt responses to timely maintain Việt Nam’s competitive position in attracting investment in the contrext that other countries have their own plans in issuing policies to respond to the GMT, which triggers a new race for post-GMT incentives.

“It’s the right time for Việt Nam to consider reforming the investment incentive system with the introduction of diverse and flexible investment policies to retain strategic investors and attract satellite businesses, thereby building an independent, self-reliant economy with inclusive and sustainable development.”

According to the World Bank, countries, when considering developing investment attraction policies, can identify four types of investment based on the motivations of investors, which are seeking natural resources, seeking market, seeking strategic assets, and seeking efficiency.

The three most important factors affecting the decision to choose a location for an investment are security, political stability, investment incentives and policy predictability.

For Việt Nam, the country has advantages in security, political stability, geographical location, and huge openness of the economy with 15 valid free trade agreements (FTAs), the World Bank pointed out, which allows Việt Nam to pursue policies to attract large-scale multinational enterprises (MNEs) with huge production capacity and close link to the global value chain.

The MPI raises seven proposals to reform investment incentives.

First, Việt Nam needs breakthrough incentive policies to attract strategic investors and high-quality investments in high technology, R&D, environment protection and in line with the country’s prioritised orientations.

Second, incentive policies must be diversified to reduce dependence on corporate income tax incentives to attract new-generation investors to increase value and keep pace with global development.

Third, tax incentives must be studied carefully, especially the cost of applying incentives must be calculated fully and announced publicly as a mandatory document for annual budget estimate and medium and long-term budget reports.

Fourth, the implementation of preferential policies on land and essential infrastructure is especially important in creating conditions for investors to start a business.

Fifth, in the short term, urgent solutions are needed to deal with the impacts of the GMT and prevent the outflow of large investors. Thus, it is necessary to pilot investment support policies focusing on high-tech groups- as the base to raise long-term reforms.

Sixth, in the long term, comprehensive reform will be implemented in the direction of not eliminating income tax incentives because this incentive remains effective for small and medium-sized investors and helps encourage investments in sub-sectors.

Seventh, it is necessary for Việt Nam to improve the investment environment and simplify administrative procedures.

The ministry recently made public a draft decree on an investment support fund as a solution to attract strategic investment when GMT is adopted. — VNS

- Reduce Hair Loss with PURA D’OR Gold Label Shampoo

- Castor Oil Has Made a “Huge” Difference With Hair and Brow Growth

- Excessive hair loss in men: Signs of illness that cannot be subjective

- Dịch Vụ SEO Website ở Los Angeles, CA: đưa trang web doanh nghiệp bạn lên top Google

- Nails Salon Sierra Madre

VnExpress News The News Gateway of Vietnam

VnExpress News The News Gateway of Vietnam