|

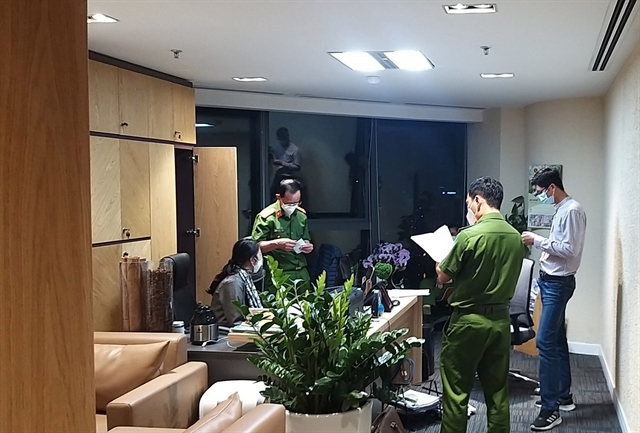

| The police search and seize documents at FLC Group’s headquarters. — VNA/VNS Photo Phạm Trung Kiên |

HÀ NỘI —The former Chairman of FLC Group, Trịnh Văn Quyết, will go on trial on July 22 for allegedly orchestrating the fraudulent inflation of FLC Faros’s charter capital by VNĐ3.1 trillion (US$123 million).

Also in the dock will be 49 defendants involved in the scheme, charged with fraud, stock manipulation, power abuses and dissemination of false information.

Prosecutors allege that Quyết instructed his associates – Doãn Văn Phương, former FLC Group’s CEO, Lê Đình Vinh, former FLC Group’s Vice-Chairman, Trần Thế Anh, a former employee in FLC Group’s Legal Department, and Trần Xuân Huy, former FLC Travel’s Director-General – to acquire Green Belt Company in 2012, which had a registered charter capital of VNĐ1.5 billion ($59,000) and rename it to Vĩnh Hà Company and later to FLC Faros Company.

After the acquisition, Quyết positioned FLC Faros as the general contractor for FLC Group’s projects. He maintained tight control over FLC Faros, issuing instructions through Phương, appointed as FLC Faros’s Chairman and his sister Trịnh Thị Minh Huế.

To generate funds for FLC Faros’s operations, Quyết implemented the capital inflation scheme by instructing Huế to prepare all the necessary documents to ‘legitimate’ fictitious capital contributions and circulating them among FLC Faros’s board members for their signatures.

The FLC Faros board comprised Phương, Trịnh Văn Đại (Quyết’s cousin), Nguyễn Văn Mạnh (Quyết’s brother-in-law), Hoàng Thị Thu Hà (Quyết’s cousin) and Đỗ Quang Lâm.

After obtaining the board’s approval, Quyết and Huế recruited 15 individuals to act as nominee shareholders. These individuals were instructed to sign various documents, including payment receipts and authorisation letters.

Once the nominee shareholders’ contributions were recorded, Quyết and Phương directed the use of these inflated funds to create the appearance of legitimate assets for FLC Faros. This involved fictitious investment contracts and business cooperation agreements with various individuals affiliated with Quyết.

Through the scheme, Quyết and his associates expanded FLC Faros’s charter capital from VNĐ1.5 billion to VNĐ4.3 trillion ($170 million).

Investigations revealed that the actual capital contributed to FLC Faros Company amounted to VNĐ1.2 trillion. The remaining VNĐ3.1 trillion constituted fictitious capital, highlighting the extent of the fraudulent scheme.

With the inflated capital serving as a facade, Quyết and his associates took FLC Faros public on the Hanoi Stock Exchange (HOSE) and managed to sell more than 391 million shares to about 30,000 investors, defrauding them of a total of VNĐ3.6 trillion.

Prosecutors also allege that certain individuals within the State Securities Commission’s Public Companies Supervision Department (PCSD), Vietnam Securities Depository Centre (VSDC) and HOSE played a complicit role in the scheme.

Three defendants from PCSD and VSDC – Lê Công Điền, Dương Văn Thanh, and Phạm Trung Minh – were accused of approving FLC Faros’s public company status and facilitating the listing of its shares despite knowing the discrepancies in its capital figures.

Four defendants from HOSE – Trần Đắc Sinh, Lê Hải Trà, Trầm Tuấn Vũ và Lê Thị Tuyết Hằng – were accused of approving the listing of FLC Faros’s shares even though they were aware of the inconsistencies in its financial statements. Their actions were motivated by Sinh’s connection with Quyết.

Three defendants from Hanoi Accounting and Auditing JSC and ASC Auditing JSC – Nguyễn Ngọc Tỉnh, Lê Văn Tuấn and Trần Thị Hạnh – were accused of giving an unqualified opinion on FLC Faros’s financial statement despite the absence of supporting evidence. — VNS

- Reduce Hair Loss with PURA D’OR Gold Label Shampoo

- Castor Oil Has Made a “Huge” Difference With Hair and Brow Growth

- Excessive hair loss in men: Signs of illness that cannot be subjective

- Dịch Vụ SEO Website ở Los Angeles, CA: đưa trang web doanh nghiệp bạn lên top Google

- Nails Salon Sierra Madre

VnExpress News The News Gateway of Vietnam

VnExpress News The News Gateway of Vietnam