Dairy giant Vinamilk is struggling to claim a bigger share of the market as its growth potential diminishes in the face of stiff competition from fast growing rivals.

Since achieving a new peak in 2018, the company’s ticker VNM has dropped by nearly 41 percent to around VND76,000 ($3.32), and the dairy firm is no longer among the top 10 biggest caps on the Ho Chi Minh Stock Exchange (HoSE).

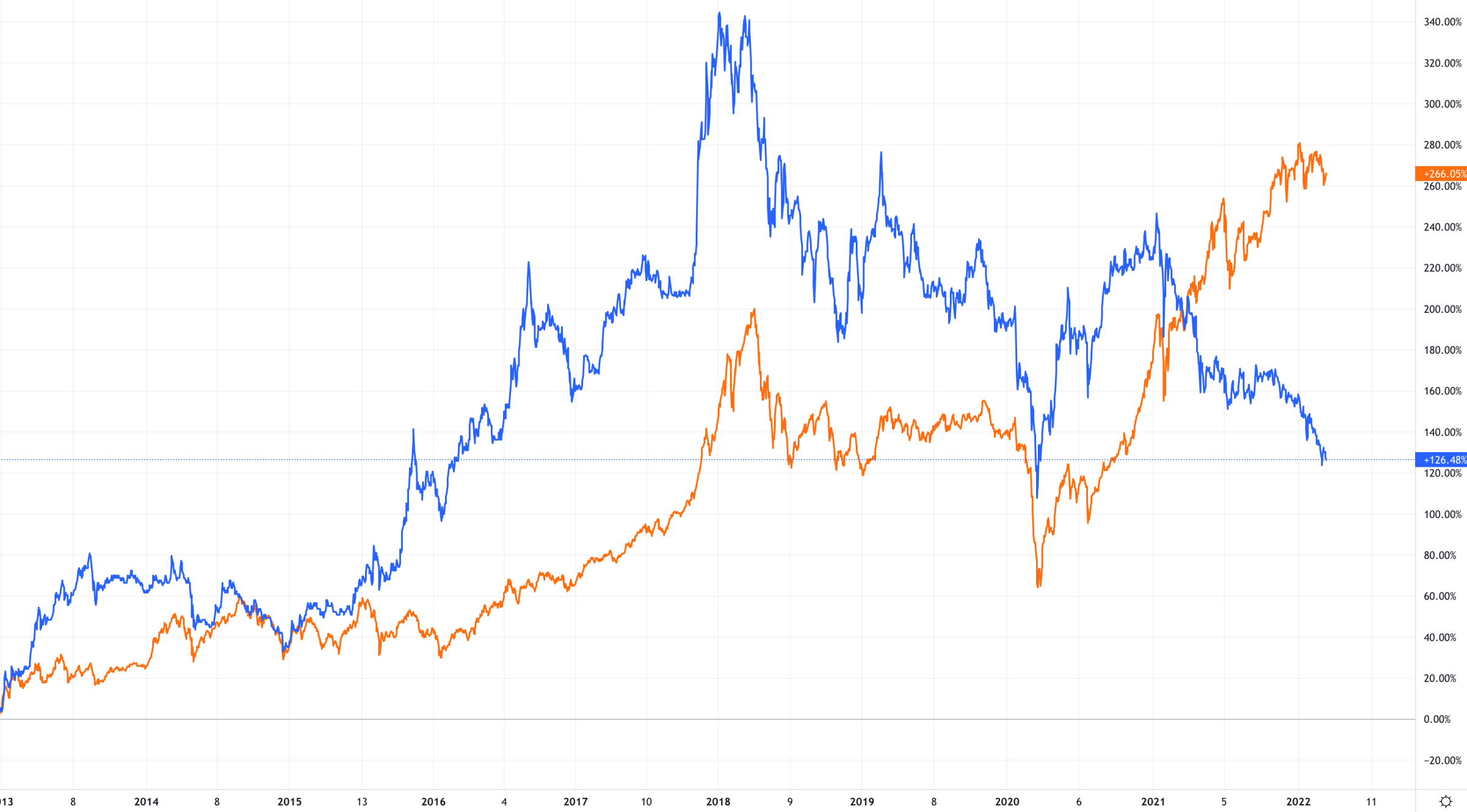

The ticker, which has been sticking to VN-Index movements for years, started to break from the benchmark in mid-2020, when it continued to fall despite a bullish market.

|

|

VNM of dairy giant Vinamilk (blue) and VN-Index (orange). Photo by TradingView |

A survey of 4,000 investors by VnExpress showed that last year, VNM was their second biggest loss-making stock behind HPG of steelmaker Hoa Phat Group.

One of the reasons was that the dairy giant had claimed the majority of the market at 60 percent and it became more difficult to gain more, said analysts with Viet Capital Securities.

This has been reflected in Vinamilk’s declining earnings from 2017 to last year, with profit growth diminishing for two years in the last five years, and only rising by single-digits in the remaining three years.

This year, the company expects its profit to decline for the second year in a row.

Its competitors, meanwhile, have seen revenues surge.

TH true Milk saw its revenue surging nearly 49 percent to VND5.5 trillion between 2017 and 2020.

Another competitor, VPMilk, has seen revenue jump five times to VND150 billion in the same period.

Another challenge that Vinamilk faces is rising input and transportation costs.

Animal feed prices jumped 30-40 percent last year and are set to continue to rise this year; while transportation costs rose 20 percent domestically and 500 percent globally last year, the company said.

In the last three years, the company has seen its gross profit margin declining from 49 percent to 42.5 percent.

The dairy giant aims reach a profit of VND16 trillion in 2026, up 33 percent from 2022.

It plans to achieve these targets by stepping up research into new products and using new technologies for sustainable livestock farming.

It also eyes new growth opportunities through mergers and acquisitions and new investments.

But analysts, however, remain conservative in their assessments.

Analysts with Vietcombank Securities said Vinamilk does not have much potential for growth in the next two or three years despite having made moves to expand exports to other countries.

- Reduce Hair Loss with PURA D’OR Gold Label Shampoo

- Castor Oil Has Made a “Huge” Difference With Hair and Brow Growth

- Excessive hair loss in men: Signs of illness that cannot be subjective

- Dịch Vụ SEO Website ở Los Angeles, CA: đưa trang web doanh nghiệp bạn lên top Google

- Nails Salon Sierra Madre

VnExpress News The News Gateway of Vietnam

VnExpress News The News Gateway of Vietnam